Being able to understand, digest and act upon capital needs is crucial for building a well-defined capital management plan. Greater transparency can allow you to automate banking structures, which in turn helps you leverage solutions that take global visibility to the next level. A recent survey showed that 40% of corporations want to streamline banking partners and accounts, which can be challenging to execute.1 There are three key steps that you can take to simplify the process and get started.

Increase visibility into your cash management

Today’s dynamic market environment means companies face volatile interest rates, inflationary pressures and rising borrowing costs. Now more than ever, treasurers need to have a holistic view of global cash positions to make informed, real-time decisions.

5 minute read

1. Evaluate your current position

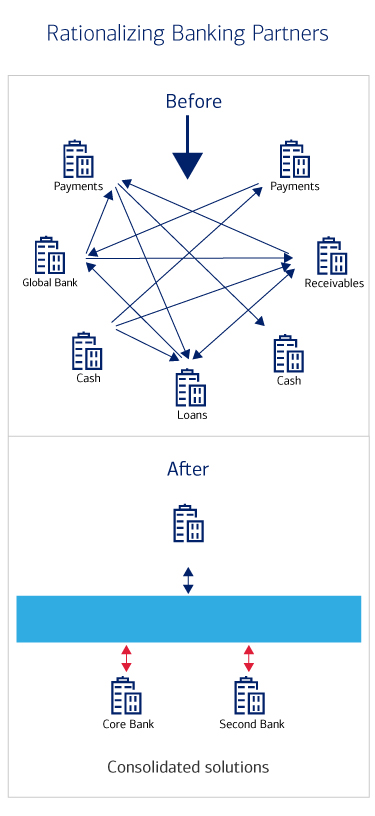

A methodical approach is crucial to ensuring a successful transition. Evaluate your current legal entities, account structures and banking relationships to differentiate what’s essential and what can be rationalized/streamlined to better fit your needs. For example, if your banking relationships and services are widely spread but your day-to-day treasury needs require an integrated suite of tools, you’re likely missing out on the efficiency that rationalization provides. Additionally, if your accounts for different entities are scattered, it can be difficult to find your consolidated real-time cash position, creating a barrier to full visibility.

2. Rationalize account structures and banking partners

Once you have a deep understanding of your current arrangements, you’ll have a clearer picture of how to rationalize. Depending on your position, your ideal banking structure may be a single banking provider or a small group of financial institutions. Because many liquidity solutions offered by major banks require full connectivity across accounts, you’ll be able to capitalize on your banking partners’ full capabilities once the rationalization is executed.

3. Access connected solutions

Solutions that work together can help automate and streamline treasury functions and provide efficient access to working capital and excess liquidity. In addition to reporting and forecasting capabilities, innovative tools such as AI and machine learning will enhance your understanding of what cash is available and where it’s held.

Tools to automate and centralize liquidity

- Physical cash concentration:

- Centralizes funds to make cash management more efficient. Offers control and visibility to handle complex cash flow challenges via a single digital platform.

- Cross-currency/cross-border sweeps:

- Provide the ability to sweep funds between two accounts in different currencies. A selection of major currencies is available with same- or next-day options, subject to local currency cutoff times.

- Move liquidity globally across regions to obtain a consolidated global position on a same-day basis, with same-day value.

- Multibank sweeps:

- Aggregate providers and balances across accounts via a single automated sweep.

- Allow seamless connection to any account within our global franchise or with your other banking partners.

Reporting tools for next-level visibility

- Multibank reporting:

- Helps minimize time and effort spent accessing multiple bank systems.

- Locates transactions quickly across primary and third-party bank accounts.

- Cash forecasting

- Provides accurate, real-time cash visibility, which is essential due to rapidly changing economic conditions.

- Bank of America’s solution, CashPro Forecasting, uses machine learning and AI to improve accuracy and efficiency.

The rewards of greater visibility

Your re-envisioned, leaner banking structure will provide a holistic view of your global cash position, which will result in several benefits:

- Productivity: You’ll spend less time navigating banking relationships, freeing up resources for activities that add value.

- Efficiency: Decision-making will become easier, as you’ll no longer have to manage the nuances between multiple banking systems.

- Analysis: Real-time information will be in one place, helping you to easily pull data and spot patterns.

- Automation: Tools such as AI and machine learning will simplify day-to-day operations.

Most importantly, greater transparency can allow you to find funds to leverage for debt paydowns, capital expenditure and general business reinvestment.

To learn more about increasing visibility into your cash management, or any other treasury needs, contact your Bank of America representative.

1 PwC Global Treasury Survey, June 2023.