Creating the financial model

Through vendor segmentation modeling, establish a phased approach to launch or expand both card-based and SCF programs. Focus on high-dollar vendors that can quickly ramp up results. Quantify the cash flow, rebate and processing cost savings based on forecasted vendor adoption for each phase.

Selling the internal business case

The change contemplated impacts multiple stakeholders, including:

• Accounts Payable

• Finance

• Treasury

• Procurement/Vendor Management

• Technology

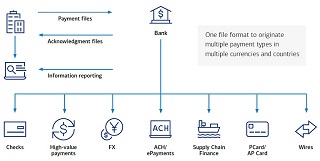

The recommended plan should go beyond outlining the financial benefits reaped by Accounts Payable, Finance and Treasury. For Procurement, vendor health will be an important improvement. For Technology, it will be to reduce complexity as the proposed platform should streamline — not complicate — the operating environment, ideally enabling one file to the bank to handle any/all payment types as follows as the buyer deems appropriate.

Picking the right provider

Choosing an experienced financial services provider that can deliver a scalable, yet modular, platform is only one piece of the puzzle. The best technology in the market will not achieve the buyer’s working capital goals unless it can be easily adopted by suppliers of all sizes and capabilities. Equally important is choosing a proven provider that has the tools and expertise to strategically segment the buyer’s vendors, establish an action plan and product fit for each vendor group, then execute the vendor marketing program to quickly sign and onboard the suppliers to achieve the financial goals.

In summary, there are more tools than ever before to leverage payments as a working capital tool and enable treasurers to have a substantial impact on the bottom line. Developing and executing the strategy can be overwhelming. Assigning a senior sponsor in the organization and engaging the chosen provider up-front to collaborate on the financial model and internal business case are vital to ensuring enterprise-wide buy-in and successful execution.