2020 will go down as a major inflection point in trade finance. Many companies began the year seeking reduced dependence on China. Then the pandemic threw global supply chains into chaos, accelerating other trends that were already underway. Here’s a deeper look at some factors driving today’s supply chain finance (SCF) evolution.

The case for supply chain finance as a service

Gaining resilience and efficiency through innovation

Key takeaways

- Global supply chains are in flux as political pressures, digitization and the pandemic reshape supplier relationships

- Momentum for near-shoring and reshoring is growing, and companies need to think through how they’ll approach this trend

- Bank of America EPS is a service that integrates into your ERP system to help eliminate manual work, increase transparency and build resilience in your supply chain

Four trends shaping supply chains

Globalization to localization—Companies are bringing production closer to home, sometimes even to their home countries. According to BofA Global Research, 75% of companies have enhanced the scope of their existing reshoring plans, despite the potential cost.1

Digitization—New solutions are helping companies cut down on paper, boost working capital, and increase visibility, speed and efficiency.

ESG—Companies are seeking ways to reduce the carbon footprint of their supply chains and broaden their supplier roster diversity. Digital trade solutions can help with both of these goals.

Supply chain viability—With the pandemic causing huge amounts of uncertainty, many large corporates have increased their focus on the financial health of their suppliers, particularly those responsible for critical components or services.

Evolution of the SCF model

These trends are driving a rapid evolution in how SCF is imagined and delivered. New options improve on traditional bank-led models of accounts payable (A/P) and accounts receivable (A/R) financing, which the majority of companies still use today.

The market is shifting to “point solutions” that use realtime API integration into clients’ ERP systems. These often work through bank/fintech alliances that combine tech innovation with relationship and financing expertise. By making use of richer data and advanced analytics, it is possible to de-risk traditional financing solutions while creating new solutions that unlock financing earlier and deeper within the value chain. In addition, by creating greater transparency and insight, additional financing can be unlocked via the wider investor ecosystem.

The next step in this evolution is supply chain as a service. This exciting blend of multiproduct platforms, cloud-based app technologies and AI can help you create a custom ecosystem based on your unique needs, enabling you to embed financing solutions directly into your ERP.

Introducing Bank of America EPS

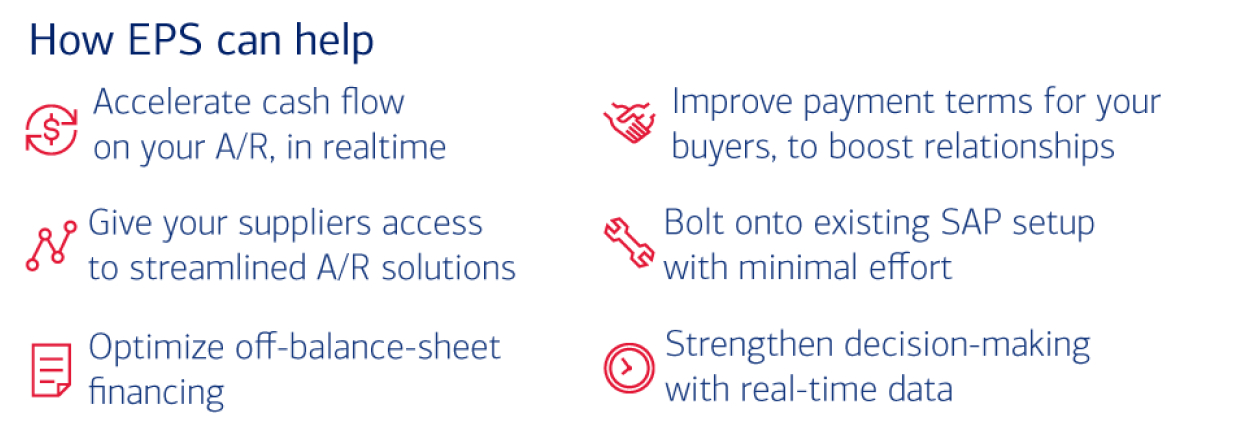

Our trade finance team is working on building supply chain as a service. Embedded Platform Solution —or EPS—will help you strengthen your and your suppliers’ resiliency and realize the benefits described above by seamlessly integrating into your ERP system. EPS can help offset the cost of reshoring, aggregate working capital info, and use artificial intelligence within your enterprise so"ware to automatically select the right invoices and receivables to finance. It is targeted initially to clients who use SAP enabled within the SAP cloud app store, and in the near future it will be available through other enterprise/procure-to-pay platforms.

While the working capital and efficiency benefits can be powerful, there are additional ways that EPS can help you reach your ESG goals. The extra visibility can make it much easier to direct financing to suppliers who meet your standards for sustainability and connect with suppliers who are closer to your customers and headquarters.

Reach out to your BofA representative to learn more about digital trade finance solutions and guidance we can offer you.

Author

Madhav Goparaju, Managing Director, Global Head of Digital Transformation, Trade and Supply Chain Finance, Bank of America